Like many other markets across the financial space, the DAX (DE30) saw a rise on Wednesday and formed a new all-time high. This was catalyzed by the, on the surface, bullish CPI m/m data announcement – but we may be running into some trouble.

Yesterday’s close saw the DAX close with a daily bearish engulfing candle. Other markets such as the S&P 500, Nasdaq 100, Dow Jones, Bitcoin, and Gold also saw red days.

This could spell some corrections coming in store for the general markets, but especially so for the DAX, which has the biggest red day among them.

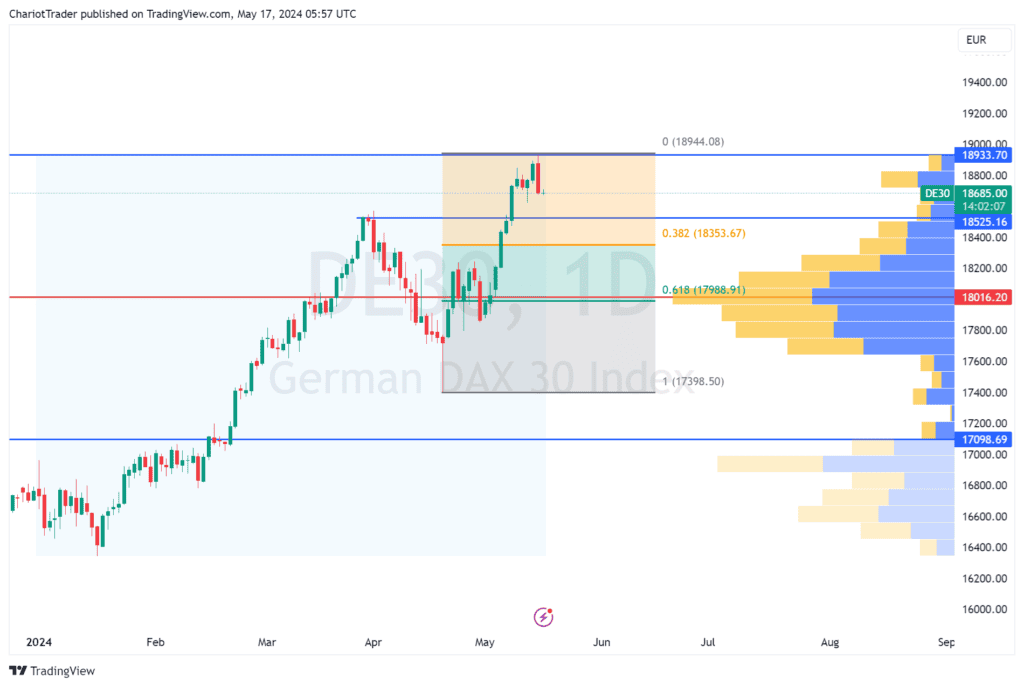

Technical Analysis of DAX 2024.05.17

The DAX (Ticker symbol: DE30 on Alchemy Markets), is now potentially facing some minor corrections.

If the DAX is to correct, we may see some support levels at the following prices:

- Previous high pivot – €18,525.16

- 0.618 Fibonacci Retracement, plus Yearly Point of Control – approximately €18,000

€18,000 is a critical level to monitor, serving as both a psychological threshold and a support level backed by multiple confluences.