Executive Summary

- Current Trend Bias: Wave 3 major rally.

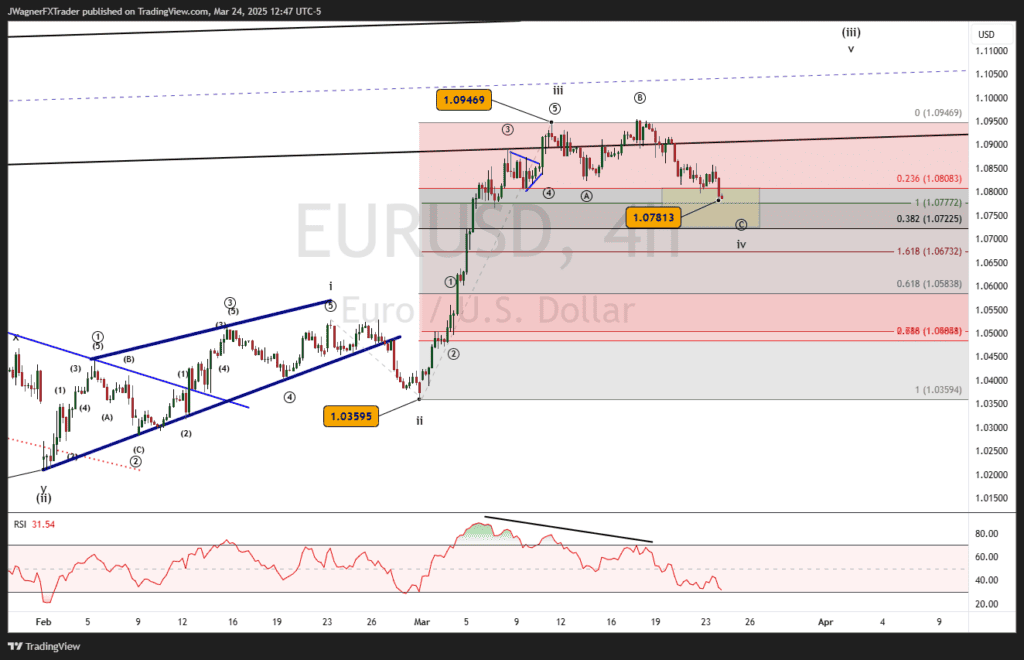

- Key Levels: Wave relationship support above 1.0650 and between 1.0722 – 1.0779.

- Forecast Implication: Though EURUSD has declined slightly, the larger trend remains higher to 1.12 due to an incomplete Elliott wave impulse pattern.

Current Elliott Wave Analysis

The EUR/USD chart shows a multi-degree Elliott wave bullish structure unfolding. At the higher degree, the chart is bullish and appears to be a larger degree wave ((iii)) [not shown].

At smaller degree, it appears wave iv of (iii) is about to terminate, leading to another rally in wave v of (iii).

Oftentimes, wave iv will retrace about 38% the length of wave iii, especially within an extended third wave as is evident above. The Fibonacci 38% retracement is near 1.0722.

Additionally, wave iv tends to retrace a similar depth as wave ii of the same trend. The previous wave ii retraced about 168 pips. A similar sized retracement from the top of wave iii on March 11, shows wave iv could retrace near 1.0779.

So we have a confluence zone of 1.0722-1.0779 as a potential reversal zone for the currently unfolding wave iv. EURUSD can dip further and likely holds above 1.0650.

We were able to anticipate the ending of wave iii and the estimate for wave iv back when we published our previous note on March 6, “EURUSD Elliott Wave: Middle of Third Wave Rally.”

Bottom Line

EUR/USD is pausing within a third wave of a larger Elliott wave impulse sequence. We suspect that a smaller degree wave iv will finalize between 1.0722 – 1.0779 with another rally carrying EURUSD up to 1.12.

Though not expected, a breakdown below 1.0650 would be a cause for concern to elevate alternate scenarios.

You Might Be Interested In: