- Weekly Outlook

- November 8, 2024

- 5 min read

From Trump Bumps to CPI Jumps: Last Week’s Market Moves & What’s on Deck

As earnings season ended, markets pivoted to major political and macroeconomic news, with Trump’s win reshaping the outlook for the economy and international relations. Trump’s election boosted equities like the S&P 500, strengthened the U.S. dollar, and lifted Bitcoin. Key interest rate decisions from the Fed, Bank of England, and Reserve Bank of Australia also marked a shift as central banks recalibrate amidst evolving fiscal and political landscapes.

Trump’s Victory: Key Economic Implications

- What It Means: With Trump back in office, investors are eyeing his agenda on tax cuts, immigration controls, and protectionist trade policies. Markets welcomed the pro-business stance, but the “America First” focus raises questions about growth sustainability amid heightened debt, immigration limits, and potential tariffs.

- Domestic Policy Focus:

- Taxes: Trump plans to extend the Tax Cuts & Jobs Act, with a focus on lowering corporate taxes, but may face legislative hurdles if Congress is split.

- Immigration: Expect a crackdown, impacting labour availability, particularly in sectors reliant on immigrant workers, potentially pushing wages and inflation higher.

- Trade: High tariffs are likely on imports, especially from China, adding costs for U.S. consumers and businesses but supporting domestic manufacturers.

- International Relations: Trump’s foreign policy could strain U.S.-Europe relations, particularly if he revisits NATO contributions and escalates tariffs on European goods.

- Market Sentiment: Positive in the short-term due to clarity on policy direction and expected tax cuts, though longer-term growth faces challenges from labour supply limits, higher tariffs, and potential inflation pressures.

Key Central Bank Actions and Rate Decisions

RBA Rate Decision Recap

- No Rate Change: The Reserve Bank of Australia (RBA) held rates steady, reflecting balanced inflation and growth outlooks.

- 2025 Growth Revision: With government spending driving inflation higher, the RBA trimmed GDP growth forecasts for 2025. Weak consumer sentiment and retail sales remain, suggesting rate cuts may start in early 2025, with the bank likely to maintain a dovish stance.

Bank of England (BoE) Rate Decision Recap

- 25bp Cut Amid UK Budget Reaction: The BoE cut rates by 0.25% this month, lowering Bank Rate to 4.75%, signalling caution over recent fiscal expansion.

- Looking Ahead: While BoE’s growth forecast rose slightly, they’ve signalled that tax hikes may moderate inflation. Rate cuts are likely to pick up pace starting in February as budgetary impacts clarify.

Federal Reserve (Fed) Rate Decision Recap

- 25bp Cut to 4.5-4.75%: The Fed reduced rates by 0.25% in response to cooling inflation and employment.

- Gradual Cuts Expected: With Trump’s win, the Fed is likely to adopt a more cautious rate-cutting pace given potential inflation from trade tariffs and tightened labour supply. Market expectations now foresee a 3.5-3.75% terminal rate, with inflation concerns likely shaping Fed decisions into 2025.

Next Week’s Economic Calendar

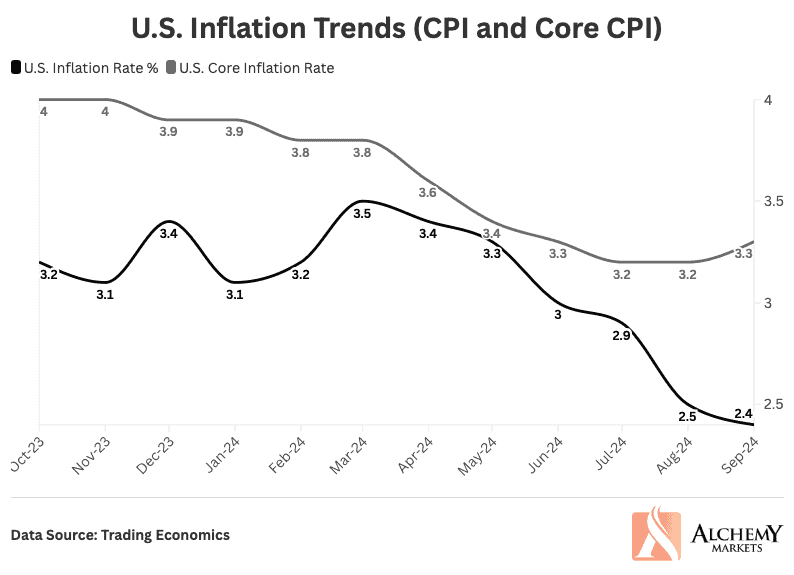

United States: Key Inflation Data (Wednesday)

- CPI: October’s CPI report is set to reflect strong price gains in the used and new car markets, likely keeping the headline CPI at 0.2% month-on-month, with core CPI projected at 0.3%. This is slightly above the 0.17% monthly pace needed to achieve the Fed’s 2% annual inflation target.

- Market Implications: Persistent inflation pressures could cast doubts over a potential Fed rate cut in December. However, with the labour market cooling and monetary policy still considered restrictive, a December cut remains likely. That said, there’s a real possibility the Fed could pause in January, given the backdrop of a smoother election outcome and anticipation of a low-tax, business-friendly climate under Trump, which could drive short-term economic growth and push inflation higher.

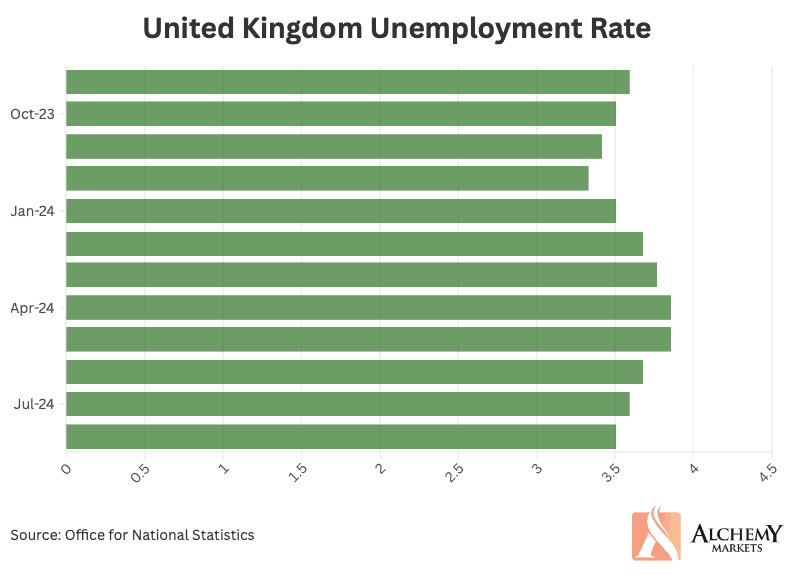

United Kingdom: Employment and GDP Data

- Jobs Report (Tuesday): Unemployment is expected to edge slightly higher, though the data has been volatile due to sampling issues. Payroll numbers have shown a considerable decline in private-sector hiring this year, and wage growth is likely to slow further. Part of this decline is due to last year’s higher base, though it also reflects softer demand in some sectors.

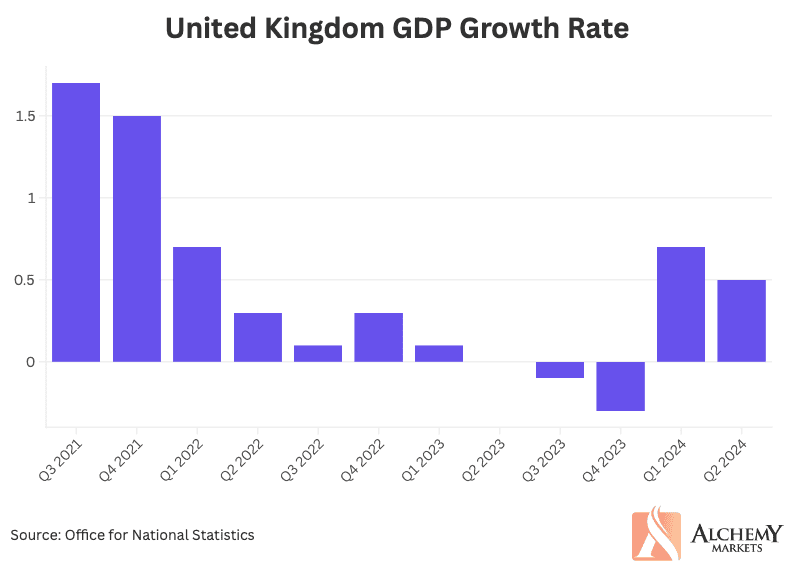

- GDP Report (Friday): Third-quarter growth is anticipated to have slowed compared to the first half of the year. This dip partly reflects data volatility from early 2024, rather than a substantial economic slowdown. While recent surveys suggest a slight loss in momentum, the UK’s latest budget is expected to support economic growth as we move into 2025.

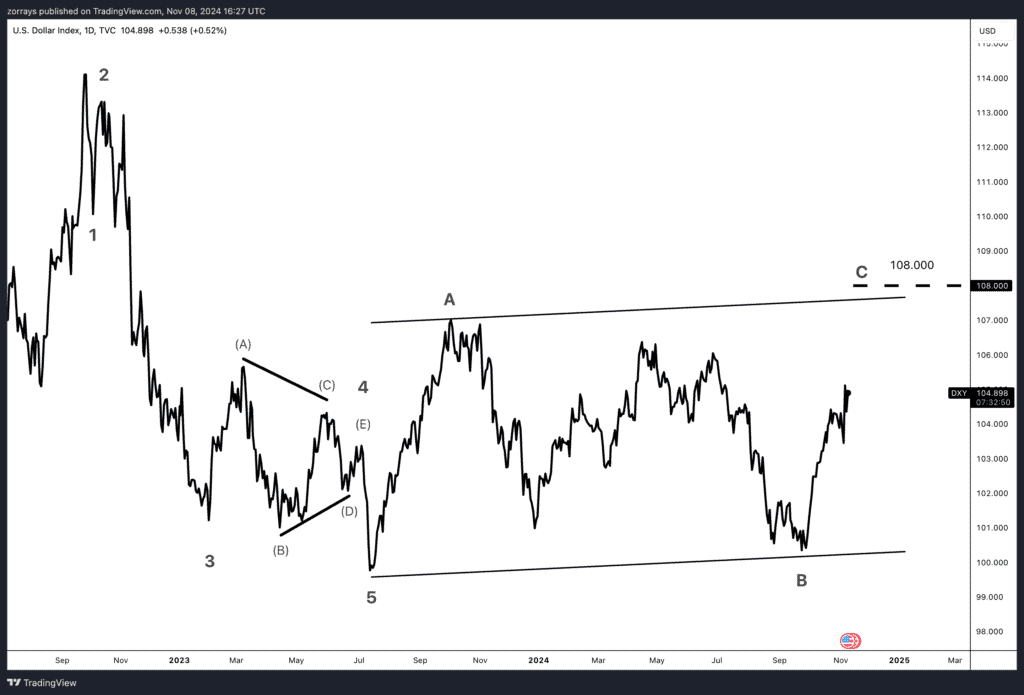

Bullish Outlook on the U.S. Dollar (DXY): Targeting 108.000 in Wave C

Source: TradingView

We are bullish on the U.S. Dollar Index (DXY), with a medium-term target of 108.000 as part of a corrective wave structure, eyeing it as a likely high for Wave C. Recent political developments—namely the Republicans’ control of both the White House and Congress—are poised to support this bullish dollar outlook. This political shift promises a more pro-business, low-tax environment, which could spur growth and drive investor confidence in U.S. assets.

Fundamental Drivers for Dollar Strength

- U.S. Political Landscape: With the Republicans’ clean sweep, the market anticipates a focus on expansionary fiscal policy, reduced regulation, and domestic economic stimulus. This backdrop increases demand for U.S. assets and boosts the dollar, with EUR/USD set for a lower profile, which inversely supports DXY strength.

- Divergence in Central Bank Policies: With inflation persisting in the U.S., the Federal Reserve remains vigilant about potential inflationary pressures from tariffs, tax cuts, and labour constraints, even as it carefully manages its rate-cutting cycle. Meanwhile, the European Central Bank (ECB) is expected to lean dovish to counterbalance Europe’s economic vulnerabilities. This Fed-ECB divergence adds upward pressure on DXY as the dollar becomes a more attractive investment relative to the euro.

- Euro Weakness: EUR/USD faces headwinds from protectionist U.S. trade policies, and potential trade tensions could further dampen euro demand. A weaker EUR/USD directly strengthens DXY, making a run-up to 108.000 in the medium term increasingly likely.

With these dynamics in play, I’m targeting 108.000 as the completion of Wave C in this corrective pattern. This level aligns well with fundamental expectations and technical structures, supporting a continued bullish view on the dollar in the months ahead.