As the Eurozone gets battered by a slew of negative economic news, the Euro takes a slump to the downside.

This drop in Euro’s valuation has sent a cascading effect throughout the market, causing the Dollar to rise, and the Nasdaq 100 (USTEC) and NVDA (Nvidia) to slump.

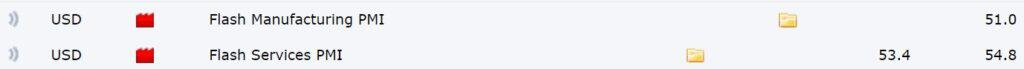

Coming briefly after the US Market Open today is the release of the US Flash PMI data, which will provide key insights into the current health of the US economy. Positive or better than expected results may accelerate the Euro’s decline, which in turn should strengthen the Dollar.

It may be a good idea for investors to wait for the US Flash PMI data release before engaging in the markets today. This data will provide valuable insights into the interest rate divergences between the Euro and US Dollar for Q3.

Key Takeaways:

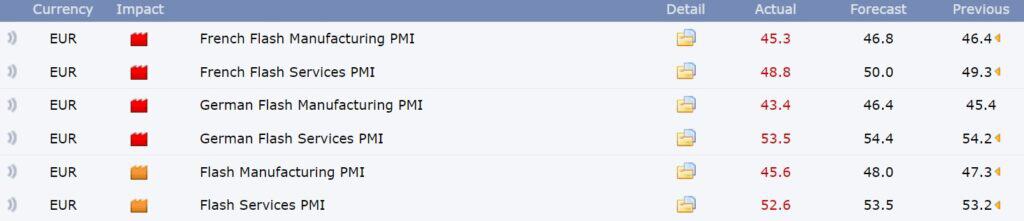

- Euro, German, and French Flash Manufacturing Services all came in lower than expected.

- EURUSD is dropping, which in turn strengthens the USD (DXY).

- Keep an eye on the upcoming US Flash PMI data as it may halt the overall market decline, or accelerate it.

Bad News For Euro, Good News for USD

Earlier today, various PMI data for the Eurozone came in lower than forecasted – signalling a weakening economy in the Eurozone.

- French Flash Manufacturing PMI (1.5 points lower)

- French Flash Services PMI (1.2 points lower)

- German Flash Manufacturing PMI (3 points lower)

- German Flash Services PMI (0.9 points lower)

- Euro Flash Manufacturing PMI (2.4 points lower)

- Euro Flash Services PMI (0.9 points lower)

Faced with these statistics, the ECB may be incentivised to cut rates on the Euro to stimulate the economy.

In response to the potential scenario, EURUSD has taken a slump to the downside, approaching the lower trendline of a symmetrical triangle visible from the Daily and Weekly timeframe.

However, one man’s trash is another man’s treasure. Due to the Euro dropping in value, the US Dollar has regained some strength today, with major resistances up ahead at 106.517, and 107.348.

If we are to hope for a decline in the DXY, the US Flash PMI data must come in significantly lower than forecasted, which will increase the demand for a rate cut.

Conversely, if the data shows that the US economy is doing fine, the Federal Reserve would have no added incentive to implement a cut.

Nasdaq 100 and Nvidia Threaten a Shooting Star Weekly Close

As the US Flash PMI data is on the horizon, the possibility for a bearish shooting star close also looms on the weekly timeframe for the Nasdaq 100 (USTEC) and Nvidia (NVDA).

If this weekly close does come into fruition, it would increase the likelihood of bearish price action in the coming weeks before we continue the overarching bull trend.

Volatility is expected to be low in the initial hours of the US market (before the US PMI Data Release), and pick up once a clearer picture of the US economy has been revealed.

Traders are advised to remain patient for the economic announcement today before placing their trades.

You may also be interested in: Candlestick Patterns Guides