Overview of the Bank of England’s (BoE) Monetary Policy Stance

On Friday, 20th September 2024, the Bank of England is set to announce its interest rate decision. Based on recent economic data and central bank communications, it is widely anticipated that the BoE will maintain its current interest rates, despite an environment marked by elevated services inflation and wage growth. However, the outlook beyond September signals the possibility of accelerated rate cuts, beginning in November.

The BoE’s cautious approach stems from persistent inflationary pressures in the UK, especially in the services sector, where inflation is higher than in the US or the Eurozone. The latest services inflation rate of 5.2% remains a concern for the central bank, and though wage growth is beginning to cool, it is still outpacing expectations. This delicate balance is leading policymakers to tread carefully, ensuring that the market does not misinterpret this pause as a signal of a rapid rate-cutting cycle.

Governor Andrew Bailey’s recent speech at the Jackson Hole symposium further solidified the BoE’s cautious stance. He presented three scenarios for persistent inflation, highlighting the complex factors influencing inflation dynamics. While Bailey leans towards a more dovish interpretation, the divided Monetary Policy Committee (MPC) makes it likely that the decision to hold rates steady will pass with a 7-2 vote.

The Hawkish Edge of the BoE Versus the Fed’s Dovish Tone

While both the BoE and the Federal Reserve (Fed) have shown dovish tendencies in their recent communications, the BoE remains slightly more hawkish in the near term. The Fed has adopted a softer tone throughout August and September 2024, signaling a broader economic slowdown in the US. In contrast, the BoE’s caution comes from the need to manage higher domestic inflation and wage growth. Despite this, neither central bank seems to be in a rush to lower rates significantly.

From a market perspective, the UK’s economic data, though not robust, has outperformed consensus expectations, particularly in comparison to the US. This resilience has led to investor optimism that the BoE will maintain higher rates than initially forecast, keeping the British pound relatively strong.

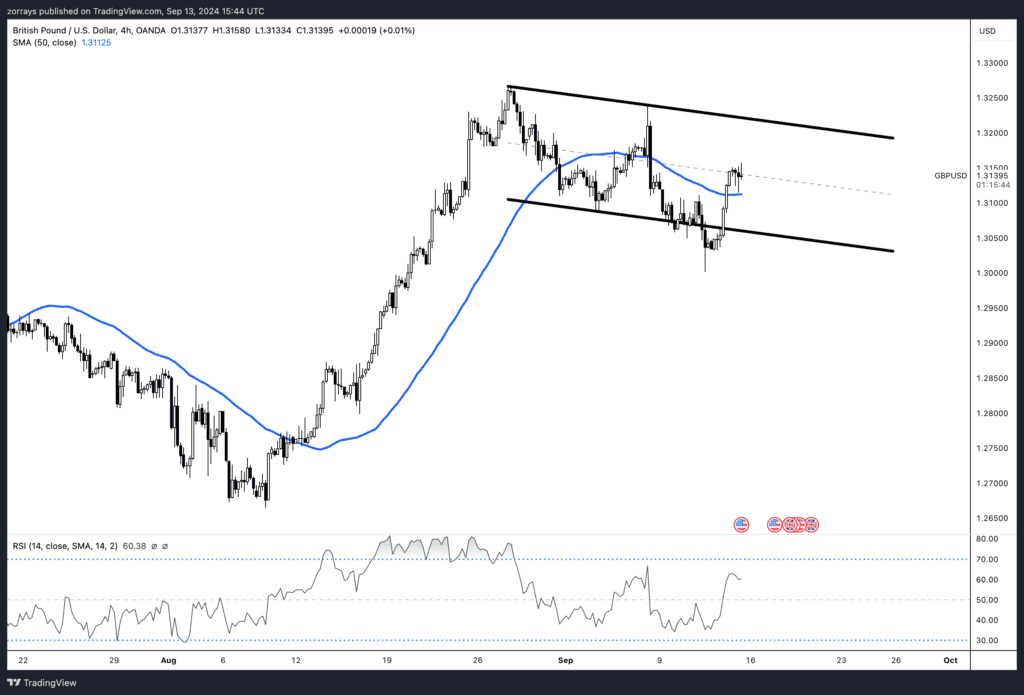

GBP/USD Technical Analysis: Bullish Momentum

The British Pound (GBP) has shown signs of strength against the US Dollar (USD) recently, with the GBP/USD pair experiencing bullish momentum. As of 13th September 2024, the pair is trading within an upward channel, supported by a 50-day Simple Moving Average (SMA) at 1.31325. This technical setup reflects a cautiously bullish sentiment, driven by expectations that the BoE will hold rates steady while maintaining a slight hawkish bias compared to the Fed.

Recent market activity shows that the pound has rallied from its lows in early September, moving from a near-term bottom around 1.2750 to its current range of 1.3133. The Relative Strength Index (RSI) is currently at 60.38, which suggests there is still room for upward movement before the pair reaches overbought levels. This positions the GBP/USD for potential gains in the near term, particularly if the BoE signals a slower pace of rate cuts compared to market expectations.

Key Technical Levels for GBP/USD:

- Resistance: 1.3200 (upper bound of the current channel)

- Support: 1.3050 (lower bound of the channel)

- 50-Day SMA: 1.31325, acting as immediate support

While the market remains cautious, the technical indicators suggest a continuation of the bullish trend, at least until new economic data or central bank communications shift the outlook.

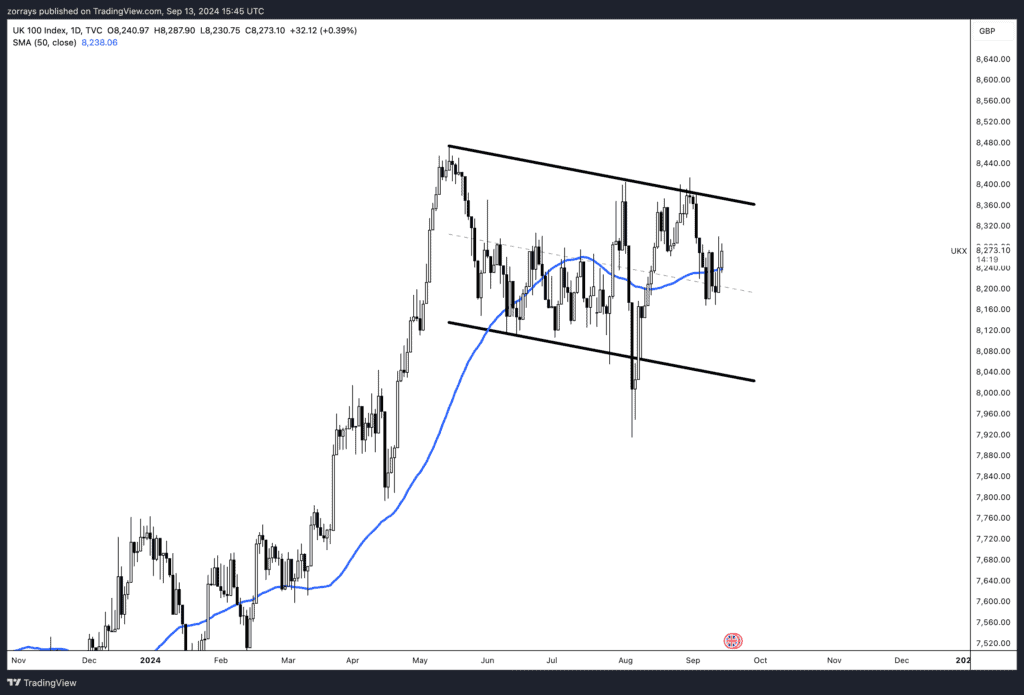

FTSE 100 Outlook: Gradual Economic Growth Priced In

The FTSE 100 index is also exhibiting bullish tendencies, with investors pricing in a slow yet steady increase in UK inflation and GDP growth. The chart reflects a pattern of higher lows and an overall upward channel, suggesting that the market expects moderate economic expansion, even though growth may be slow. The FTSE 100 recently closed at 8,273, with its 50-day SMA providing a robust support level at 8,238.

Inflation remains a focal point, but unlike other major economies, the UK is expected to see gradual growth in its GDP, driven by consumer spending and steady wage growth. This positive outlook is keeping the FTSE 100 buoyant, with the market pricing in stable corporate earnings as inflation gradually cools.

Key Technical Levels for FTSE 100:

- Resistance: 8,360 (upper bound of the current channel)

- Support: 8,120 (lower bound of the channel)

- 50-Day SMA: 8,238, providing strong support

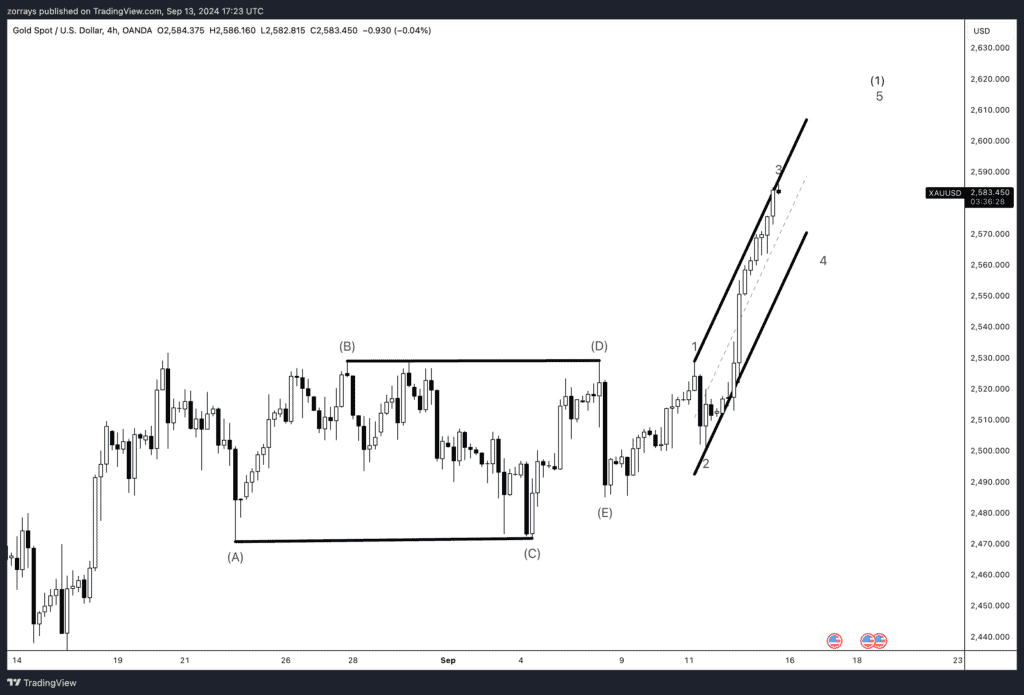

Technical Analysis Recap: Gold’s Bullish Breakout

In Monday’s article, I highlighted a potential breakout scenario for Gold (XAU/USD), citing a bullish outlook based on an Elliott Wave triangle formation. The price had been consolidating in a sideways range, reflecting a wave (A-B-C-D-E) structure. I anticipated that this consolidation was setting the stage for a significant move upward, and as predicted, gold has indeed broken out of the triangle pattern.

Since Monday, gold has climbed 4%, confirming the breakout and reinforcing the bullish momentum that had been developing. The chart now clearly shows that wave (1) and wave 3 of the Elliott Wave impulse are pushing higher, suggesting that further gains could be expected in the coming sessions.

Conclusion

As we approach the BoE’s rate decision on 20th September 2024, markets are poised for a steady interest rate environment, with the BoE likely to hold off on rate cuts until November. The cautious stance of the BoE contrasts with the more dovish tone of the Federal Reserve, giving the British pound an edge in the short term. Both the GBP/USD currency pair and the FTSE 100 index are positioned for potential gains, supported by technical indicators and investor sentiment.

However, any surprises in the MPC vote split or changes in the policy statement could lead to increased volatility in the markets. For now, the outlook remains moderately optimistic, with inflation expected to cool and economic growth to continue at a measured pace.