As we look ahead to next week’s economic data, the recent inflation report provides a more benign outlook. The August personal income and spending report’s core PCE deflator, the Federal Reserve’s preferred inflation gauge, came in at 0.1% month-on-month, lower than the expected 0.2%. When measured to two decimal places, the result was 0.13%, comfortably below the 0.17% threshold that would suggest inflationary pressures are mounting. This indicates that inflation is staying within the Fed’s comfort zone, allowing the central bank more flexibility in its interest rate decisions. The year-on-year core PCE inflation rate edged up to 2.7%, but this should ease in the coming months due to tough base effects from late 2022.

The Jobs Market: The Key to Future Fed Rate Decisions

While inflation seems to be under control, the Federal Reserve is now focused on the labour market. The Conference Board’s latest consumer confidence report showed that job security concerns are rising, suggesting growing headwinds for consumer spending. This puts the labour market squarely in the spotlight. If the unemployment rate ticks up to 4.3% in next Friday’s jobs report and payroll growth slows to below 75,000, the pressure on the Fed to implement deeper rate cuts will intensify. A second 50-basis-point rate cut could be on the table if the jobs market shows significant signs of weakening.

Upcoming Economic Data for the Week: Key Events to Watch

- UK GDP QoQ (Monday)

- The UK’s GDP growth for Q2 is expected to slip slightly from 0.7% to 0.6%. This slight decline could further convince the Bank of England (BoE) to maintain or even deepen future rate cuts, particularly as the UK inflation rate has reached its target. The Monetary Policy Committee is closely monitoring these developments as they remain divided on whether to cut rates further.

- US ISM Manufacturing PMI (Tuesday)

- The manufacturing sector has been a persistent weak spot for the US economy. The ISM Manufacturing PMI is expected to come in at 47.2, continuing to signal contraction (below 50). This data will be a crucial indicator of how much pressure the industrial sector is facing, especially with rising interest rates and tightening financial conditions.

- US ISM Services PMI (Thursday)

- In contrast to manufacturing, the service sector is still expanding, with the ISM Services PMI expected to remain above 50, at 51.5. However, slowing growth in this sector would suggest that the overall economy is cooling. Employment data within these PMIs will provide more clues on the health of the labor market, as both reports include details on hiring trends.

- Non-Farm Payrolls (NFP) Report (Friday)

- The most critical release of the week will be the Non-Farm Payrolls (NFP) report. Job growth has slowed in recent months, and if we see another weak print, it will fuel expectations for deeper Federal Reserve rate cuts. The unemployment rate is also a key metric to watch—if it rises above 4.3%, it would reinforce the narrative that the labor market is cooling faster than expected.

Key Themes for the Week

- Fed Policy Flexibility: With inflation looking subdued, the Federal Reserve has leeway to adjust interest rates, but the speed and scale of future cuts depend on the labor market.

- UK Growth Outlook: The slight decline in GDP growth could lead to additional rate cuts by the BoE, especially with inflation already at its target.

- Manufacturing vs. Services: The split between contraction in manufacturing and modest growth in services will give insight into how broad-based the economic slowdown may be.

- NFP Jobs Report: As always, the NFP report will be the main event, with the potential to significantly alter expectations for Federal Reserve policy.

What This Means for Markets

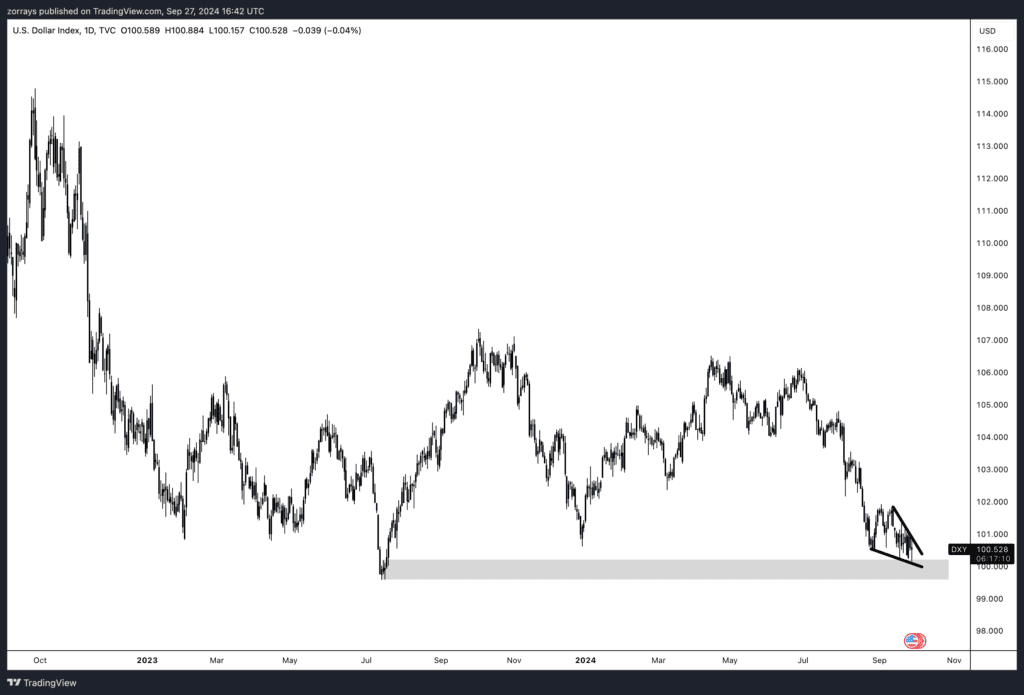

DXY (U.S. Dollar Index)

Looking at the DXY chart, we see the U.S. dollar testing a critical support zone, around the 100.50 level, which has been in play for several months. The market is highly anticipating a breakdown of this support. Should we receive positive data from both the NFP and ISM reports, the dollar could react bearishly. Unlike earlier in the year, when the market sought weaker data to signal cooling inflation and potentially prompt Federal Reserve rate cuts, the narrative has shifted. Investors now want to see signs of economic recovery. Stronger economic data could bolster confidence in growth, reducing the safe-haven appeal of the dollar and potentially driving it lower as risk-on sentiment returns.

- Key Levels to Watch: A break below the 100 support could lead to further downside.

- Market Sentiment: Bearish on positive NFP and ISM data, as risk appetite would rise, hurting the dollar.

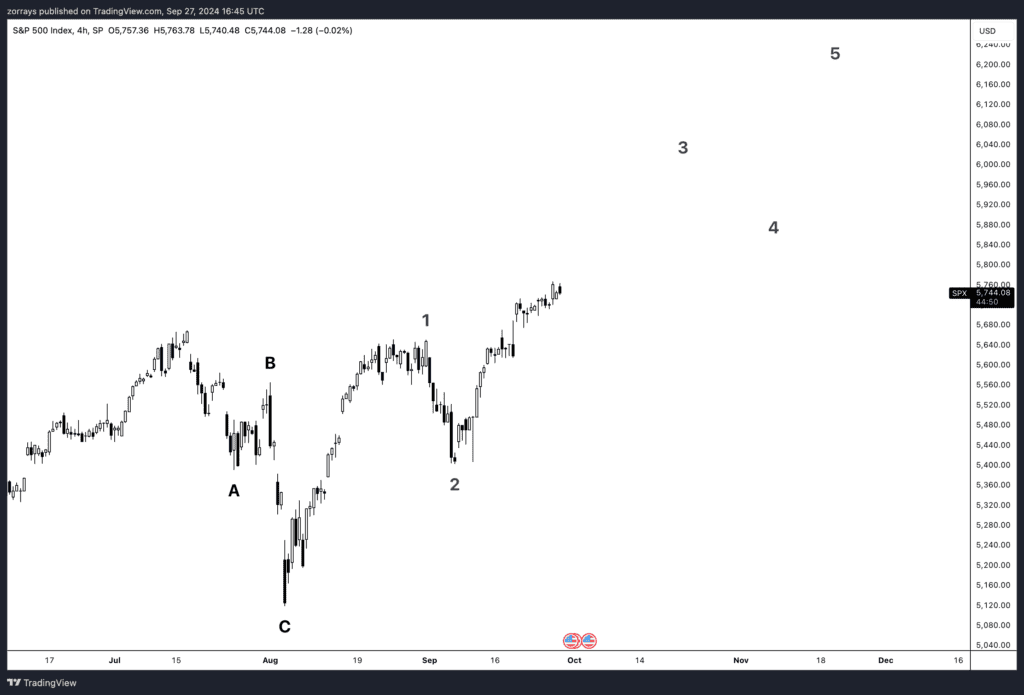

S&P 500 Index (SPX)

Turning to the SPX chart, we observe that the index has been performing well, potentially unfolding a bullish Elliott Wave structure. The current upward movement seems to be part of a 5-wave impulse wave pattern, with wave 3 nearing completion. Should we receive strong NFP and ISM data next week, it could act as a catalyst for wave 4 to retrace modestly, before wave 5 propels the SPX higher, reflecting an improving economic outlook.

- Wave Count: We are potentially in wave 3 of a 5-wave Elliott impulse structure. Wave 4 could provide a brief pullback before a final push higher in wave 5.

- Outlook: A stronger-than-expected NFP and ISM would likely send the SPX higher, confirming the 5-wave structure and reinforcing the bullish sentiment for equities.

In summary, if we get positive economic data next week, we can expect a bearish dollar and a bullish SPX, as the narrative has shifted towards favouring strong economic recovery rather than weak data signalling inflationary cooling.

Next Week’s Key Data in Summary

- Monday: UK GDP QoQ (Expected: 0.6%)

- Tuesday: US ISM Manufacturing PMI (Expected: 47.2)

- Thursday: US ISM Services PMI (Expected: 51.5)

- Friday: US Non-Farm Payrolls

The data flow next week will be critical in shaping expectations for monetary policy as the Fed balances a benign inflation environment with a cooling labor market. Stay tuned for key releases, particularly the jobs report, which could set the tone for the Fed’s next move.